A common rule of thumb for dividend investing is to look for dividend stocks with payout ratios below 80% — stocks where dividends per share account for no more than 80% of EPS. A higher payout ratio is often a sign that a dividend is unsustainably high, as the company would have to go into debt or cut its dividend in the event of a small downturn in earnings. Earnings per share means the money you would earn for owning each share of common stock. A higher earning per share indicates that a company has better profitability. Since it is a small company, there are no preferred shares outstanding. Quality Co. had 5,000 weighted average shares outstanding during the year.

Basic Earnings Per Share Calculation Example (EPS)

It shows whether profits have been distributed mainly to shareholders, or mostly retained within the business. In this way, it can be seen that companies with higher EPS ratios are more likely to have a successful business model that is geared toward higher levels of returns to shareholders. Any stock dividends or splits that occur must be reflected in the calculation of the weighted average number of shares outstanding. Some data sources simplify the calculation by using the number of shares outstanding at the end of a period.

How is EPS reported?

However, the P/E ratio can help investors understand whether they’re paying a lot for the company’s earnings or a little. However, the expectations set by analysts also play a role in determining the impact of EPS on the stock price. If a company reports solid EPS growth but falls short of analysts’ expectations, it may lead to the stock price remaining stagnant or even declining in the short term. With EPS and the P/E ratio, investors have an easy way to compare companies, letting them quickly judge the profit represented by each share of stock and how much they’re paying for it. Real estate investment trusts (REITs), which are also popular among dividend investors, are required by law to pay out at least 90% of their taxable income as dividends. They get special tax breaks that help make higher payout ratios more sustainable.

- Research firms then compile these forecasts into the “consensus earnings estimate.”

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Higher earnings per share is always better than a lower ratio because this means the company is more profitable and the company has more profits to distribute to its shareholders.

- If a company reports solid EPS growth but falls short of analysts’ expectations, it may lead to the stock price remaining stagnant or even declining in the short term.

- The formula in the table above calculates the basic EPS of each of these select companies.

- By dividing a company’s share price by its earnings per share, an investor can see the value of a stock in terms of how much the market is willing to pay for each dollar of earnings.

Best Brokerage Accounts for Stock Trading

EPS is typically used by investors and analysts to gauge the financial strength of a company. In fact, it is sometimes known as the bottom line where a firm’s worth is concerned, both literally (as the last item on the income statement) and figuratively. Diluted EPS, which accounts what is a capital lease versus an operating lease for the impact of convertible preferred shares, options, warrants, and other dilutive securities, was $1.56. The earnings per share metric, often abbreviated as “EPS”, determines how much of a company’s accounting profit is attributable to each common share outstanding.

Net income is the amount related to shareholder equity after costs and expenses have been deducted from a company’s income. Most P/E ratios are calculated using the trailing EPS because it represents what actually happened, and not what might be. On the other hand, while the figure is accurate, the trailing EPS is often considered old news. In the next part of our exercise, we’ll determine our company’s diluted earnings per share (EPS). Of the $250 million in net earnings, $25 million was issued to preferred shareholders in the form of a dividend. Companies generally report both basic earnings per share and diluted earnings per share.

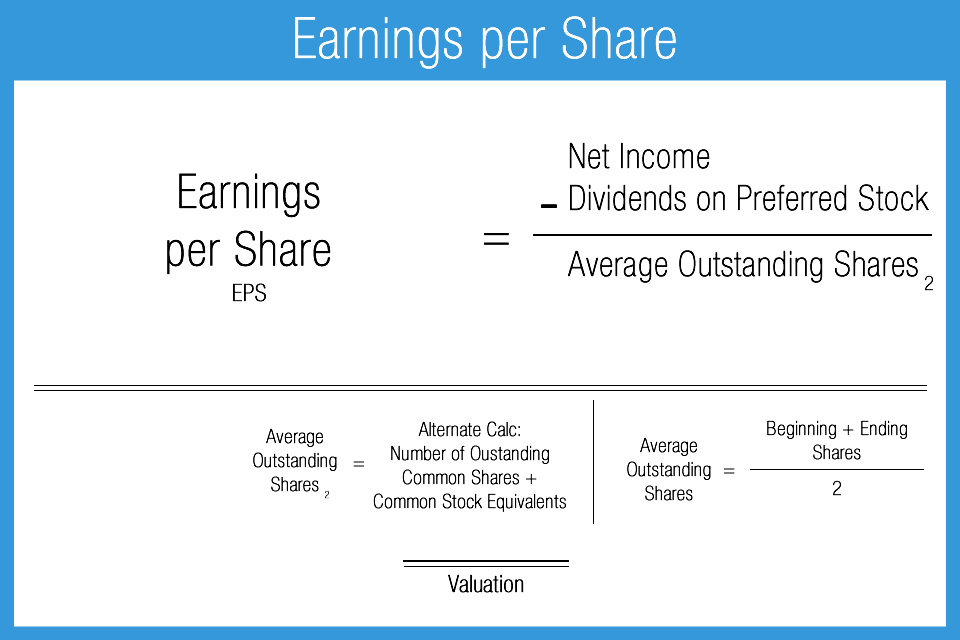

By providing a common base metric, EPS makes it easier to compare companies, each of which has a different number of outstanding shares, stock price and profits. To find EPS, take the company’s net income (and deduct preferred dividends, if applicable) and divide that by the average number of shares of outstanding common stock. You’ll notice that the preferred dividends are removed from net income in the earnings per share calculation. This is because EPS only measures the income available to common stockholders. Preferred dividends are set-aside for the preferred shareholders and can’t belong to the common shareholders.

Diluted EPS is usually lower than basic EPS because it takes into account the potential dilution of earnings that could occur if all dilutive securities were exercised. Earnings per share or basic earnings per share is calculated by subtracting preferred dividends from net income and dividing by the weighted average common shares outstanding. Earnings per share (EPS) measures the amount of total profit earned per outstanding share of common stock in a specific period, usually either a quarter or a year. It’s one of the most fundamental financial metrics, and in conjunction with the price-to-earnings ratio, allows investors to gauge the stock price relative to a company’s profits.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. There are several types of earnings per share, including cash, reported, continuous/pro forma, carrying value, and retained EPS. A pro forma or continuing earnings per share is a variant of earnings per share that excludes one-time events and extraordinary occurrences. For example, if a company has 100 units of common shares and makes 1000 USD to pay shareholders, each share unit will be worth 10 USD.